Authenticating Artworks Through DNA

April 4, 2025

The Role of Carbon Dating in Art Authentication

March 28, 2025

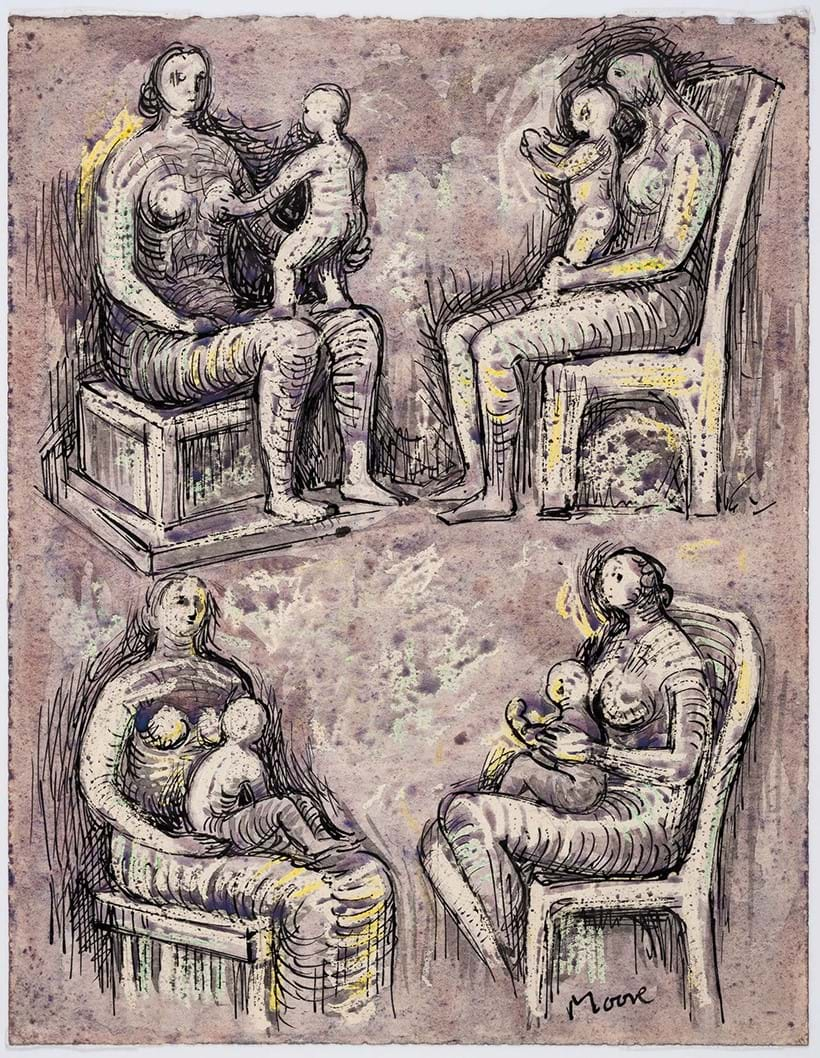

The Role of the Catalogue Raisonné in Art Authentication

March 25, 2025

The Role of the Rabbet in Art Authentication

March 21, 2025

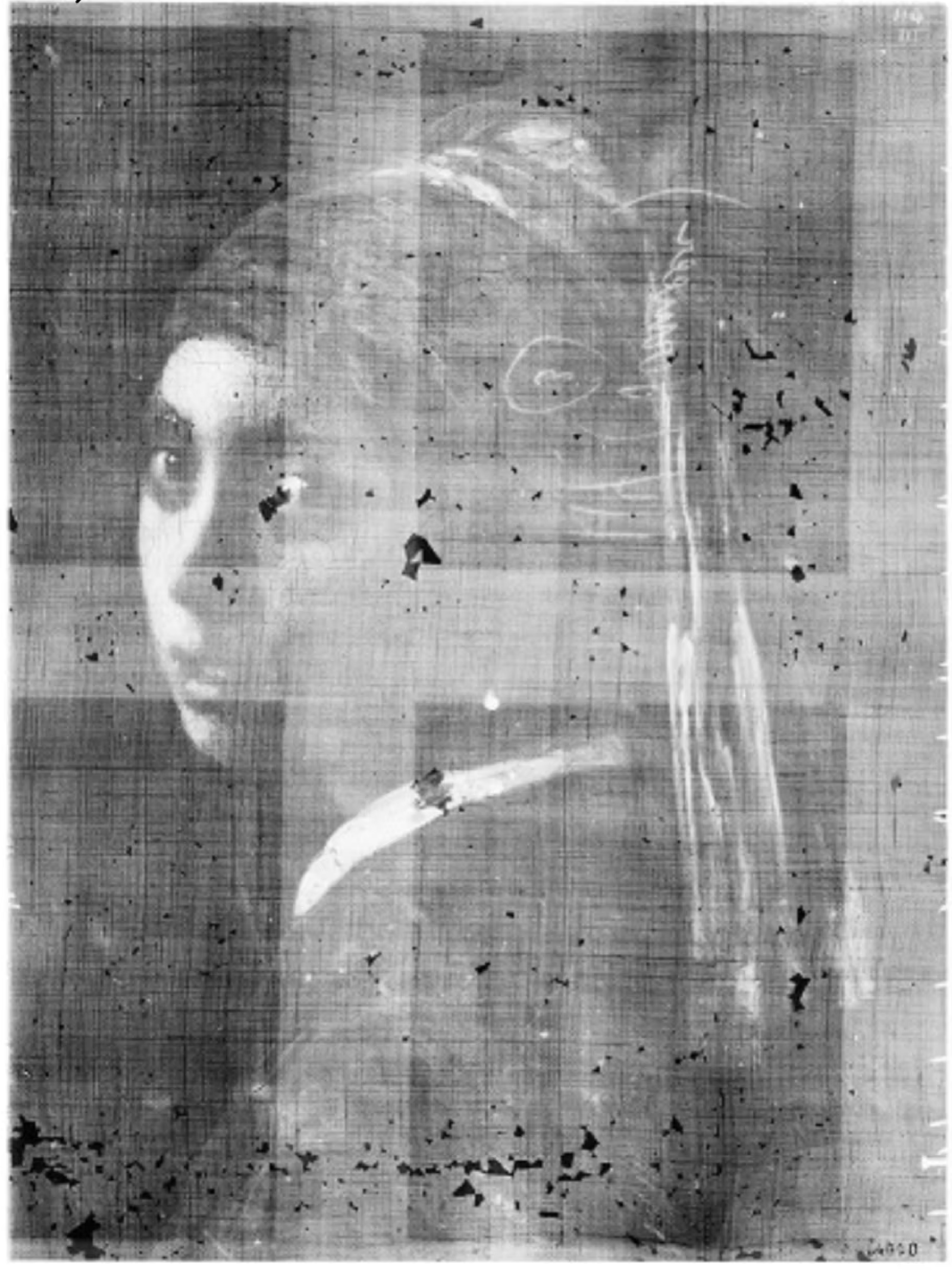

The Role of X-Rays in Art Authentication

March 18, 2025

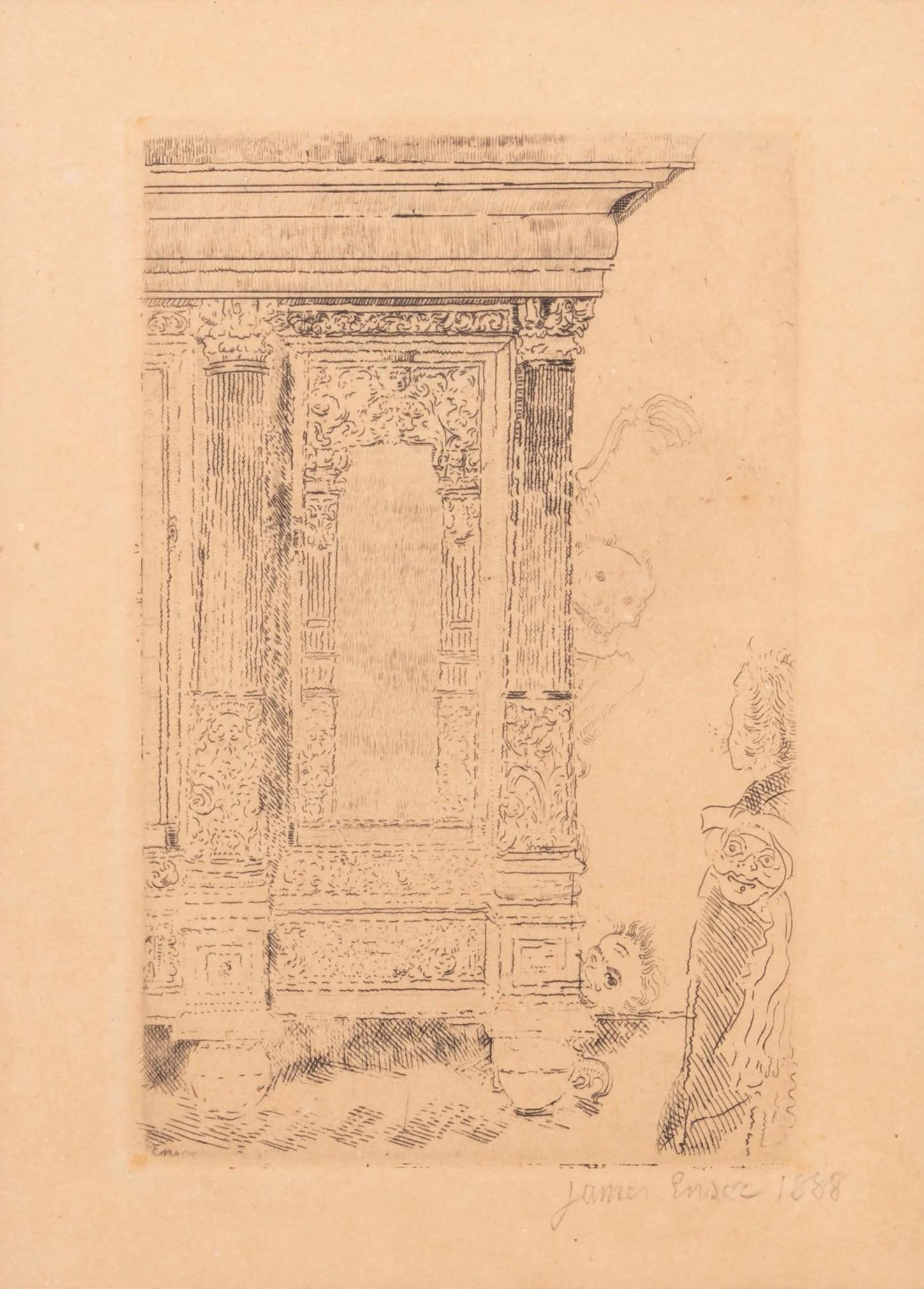

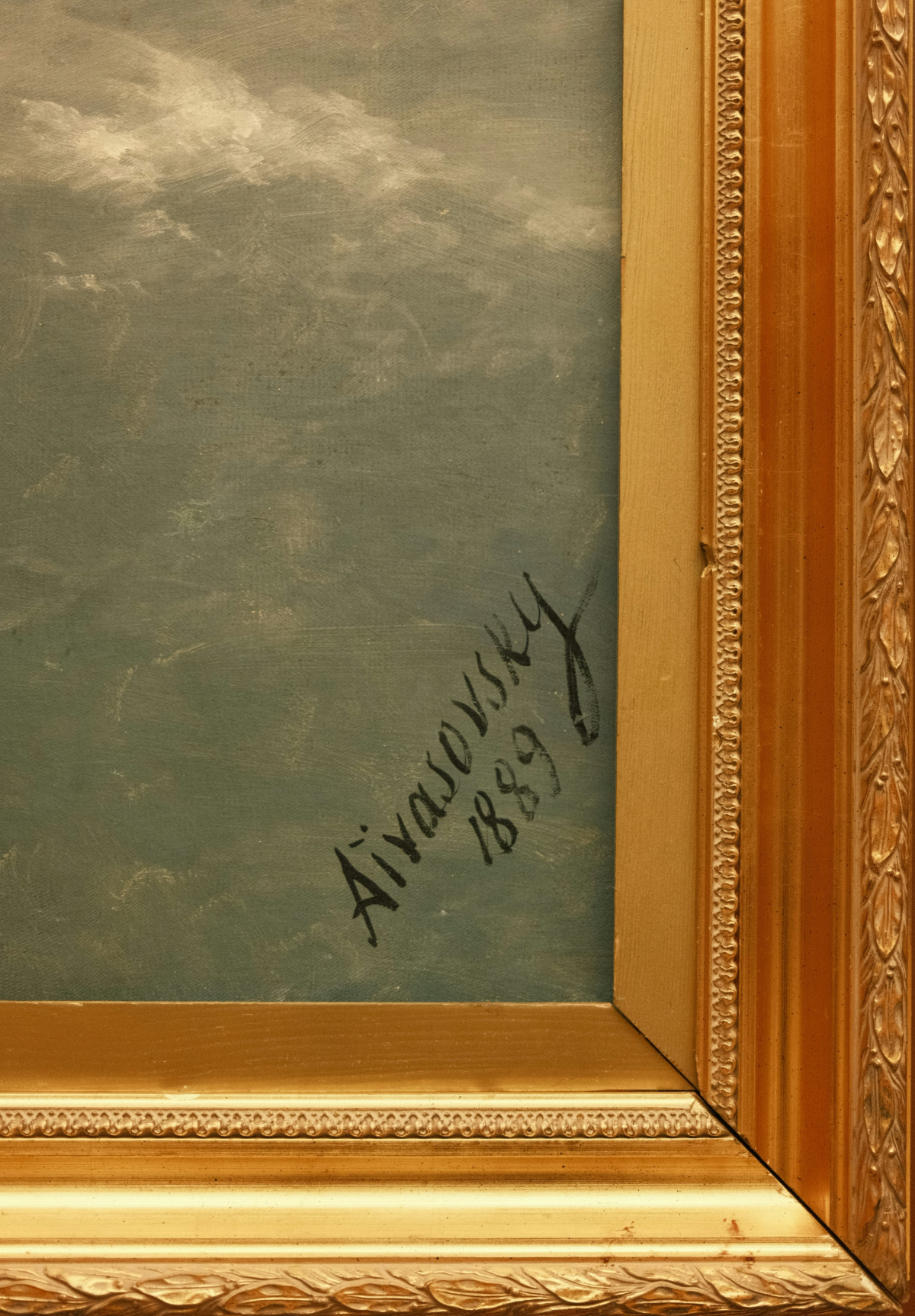

The Role of Signatures in Art Authentication

March 14, 2025

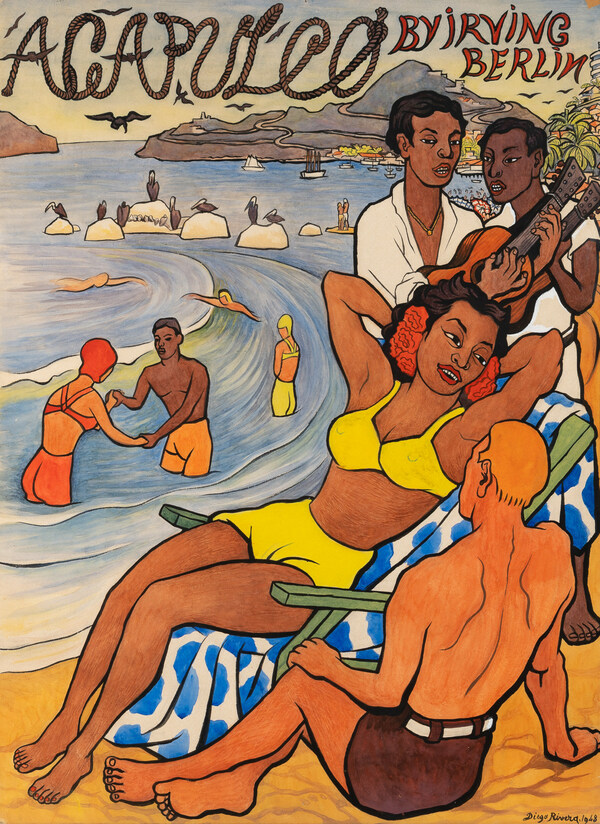

The Role of Provenance in Art Authentication

March 11, 2025

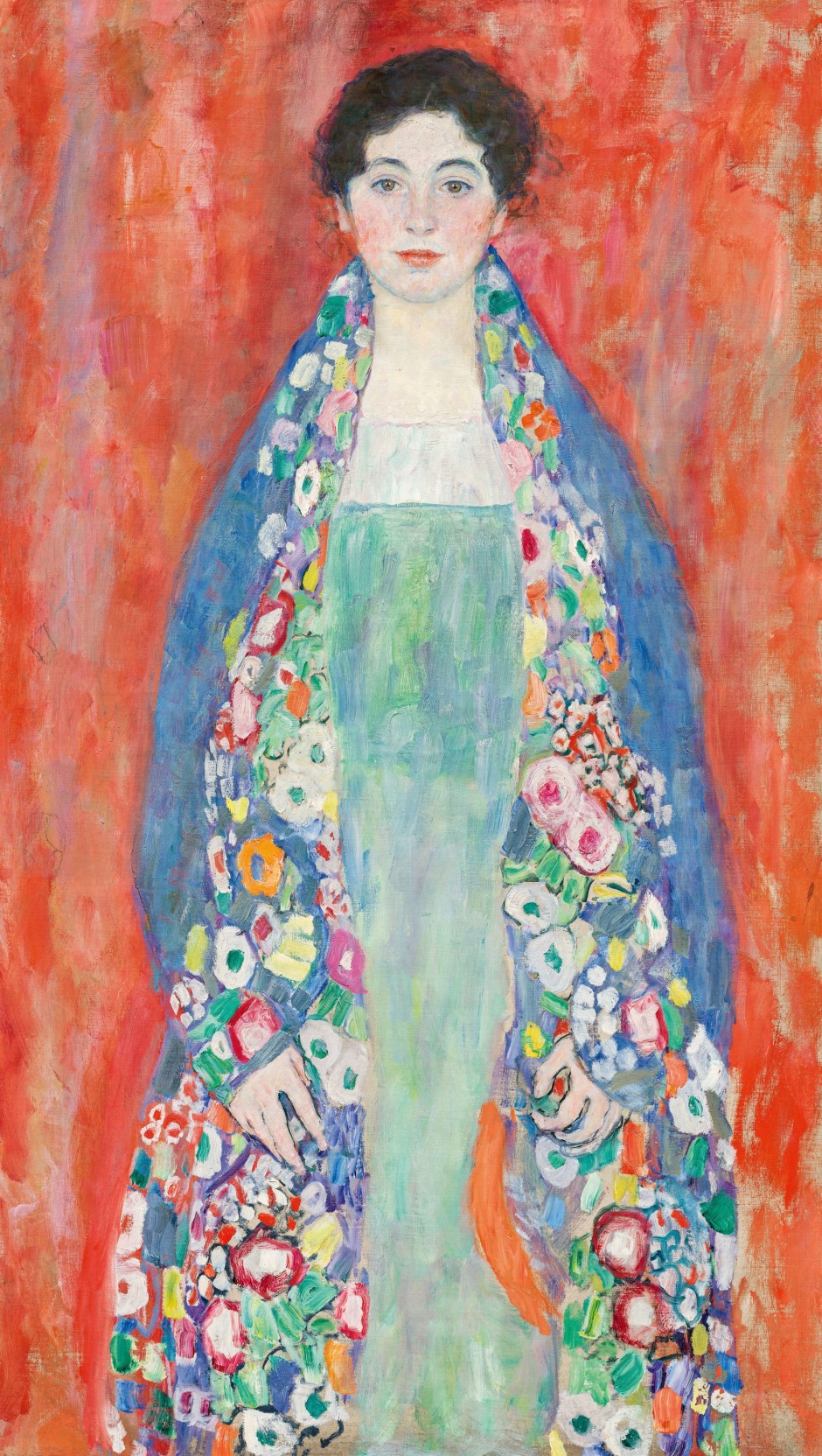

How to Sell Art in the Millions of Dollars

March 7, 2025

How to Sell Art in the Hundreds of Thousands of Dollars

March 4, 2025

How to Sell Art in the Tens of Thousands of Dollars

February 28, 2025

How to Sell Art in the Thousands of Dollars

February 25, 2025

How to Sell Art in the Hundreds of Dollars

February 21, 2025

Why Paintings Must Be Authenticated

February 18, 2025

Art Certification Experts Year End Summary

January 15, 2025

Art Speculating

January 03, 2024